Elevate Your Operations and Slash Your 2023 Tax Bill

Enjoy 35% Tax Savings on High-Quality Printing and Mailing Solutions with the IRS Section 179 Accelerated Depreciation

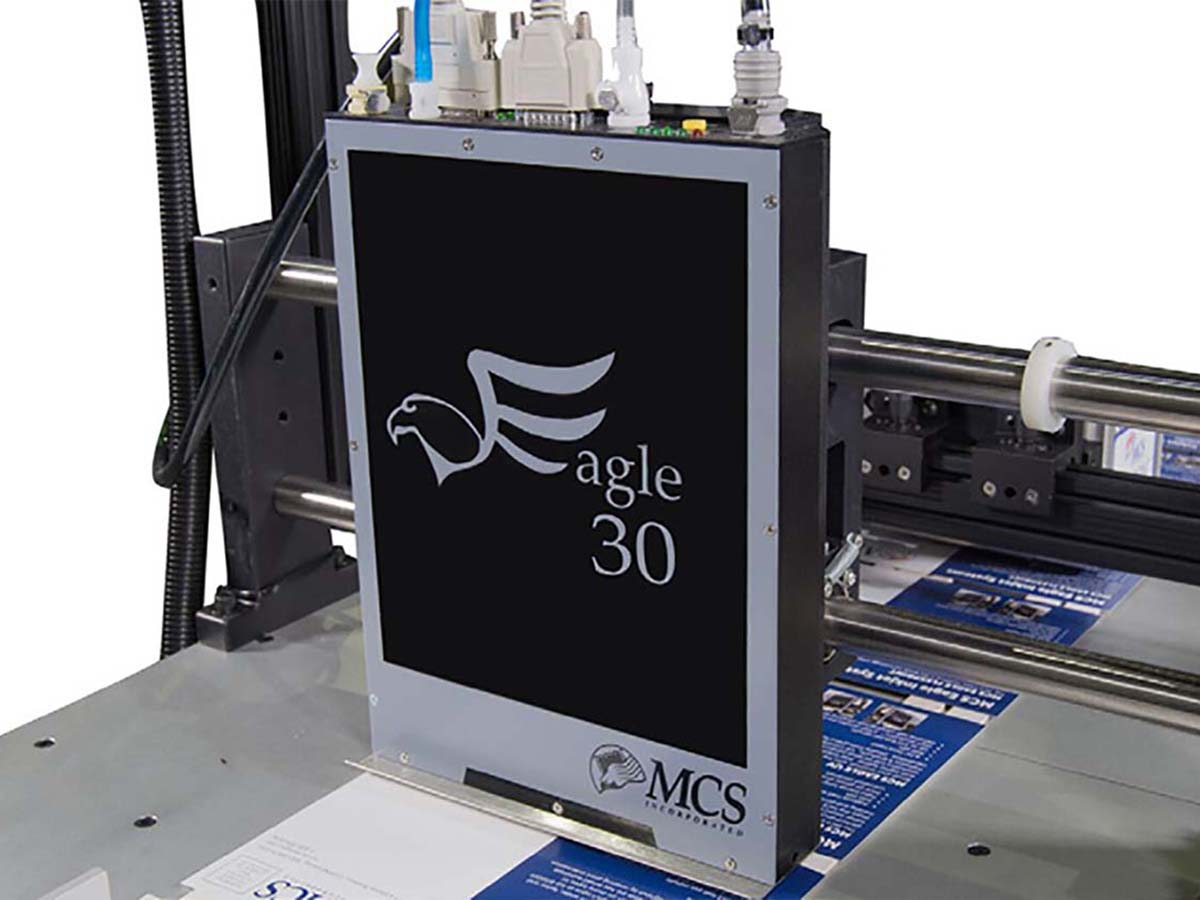

Add-Jet Technologies is your ultimate destination for high-quality, state-of-the-art commercial digital printing presses and mail and envelope inserters. Our products are in stock, ready for immediate delivery, and qualify for incredible tax benefits under IRS Section 179 Accelerated Depreciation. Act now, and you can write off the full cost of your new equipment on your 2023 taxes, leading to substantial savings of up to 35%.

The advantages of leveraging IRS Section 179 are manifold. This tax code allows businesses to immediately deduct the total purchase price of qualifying equipment, up to a maximum of $1,050,000, in the year the purchase is made. In short, this means you can dramatically reduce your 2023 tax bill while modernizing your operations. But don’t delay. This opportunity expires at the end of the year, making now the optimal time to invest in your business’s future.

But the benefits don’t end there. To make new equipment even more attainable, Add-Jet Technologies offers 90-day payment terms with no cash outlay required in 2023. Today, you can enhance your printing and mailing operations without straining your cash flow. Coupled with the significant tax savings from IRS Section 179, it’s clear that upgrading your equipment is a financially wise move.

Contact Add-Jet Technologies today to learn how we can elevate your operations while offering you significant savings. With our top-of-the-line equipment, immediate availability, generous payment terms, and unbeatable tax incentives, there has never been a better time to invest in your business.